Cboe Global Markets (CBOE)·Q4 2025 Earnings Summary

Cboe Crushes Q4 with Record Revenue as 0DTE Options Surge 66%

February 6, 2026 · by Fintool AI Agent

Cboe Global Markets delivered record fourth-quarter results, with net revenue of $671.1 million (+28% Y/Y) and adjusted EPS of $3.06 (+46% Y/Y) — both handily beating Street expectations . The quarter was powered by explosive growth in zero-days-to-expiration (0DTE) SPX options, which surged 66% Y/Y to a record 2.6 million contracts per day . Despite the strong beat, the stock dropped 2.6% in after-hours trading as investors digested conservative 2026 guidance calling for only "mid single-digit" organic revenue growth.

Did Cboe Beat Earnings?

Yes — decisively. Cboe beat on both top and bottom lines:

This marks Cboe's fourth consecutive quarterly EPS beat and caps a record year with full-year net revenue of $2.43 billion (+17% Y/Y) and adjusted EPS of $10.67 (+24% Y/Y) .

Beat/Miss History

What Drove the Record Quarter?

The 0DTE Phenomenon Continues

The standout story remains Cboe's proprietary SPX options franchise, where 0DTE (same-day expiration) trading has become a secular growth engine :

- SPX options ADV: 4.3 million contracts (+39% Y/Y) — a record; 9 of 10 highest days ever occurred in Q4 2025 or Q1 2026

- 0DTE SPX ADV: Up 66% Y/Y — now 61% of all SPX volume (up from 51% a year ago)

- Mini-SPX 0DTE ADV: Up 135% Y/Y — now makes up over half of Mini-SPX volume

- VIX options: Third consecutive record year at 862,000 contracts/day avg in 2025

- Russell 2000 options: Volume jumped 20% to highest level in ~10 years; adding to GTH session in February

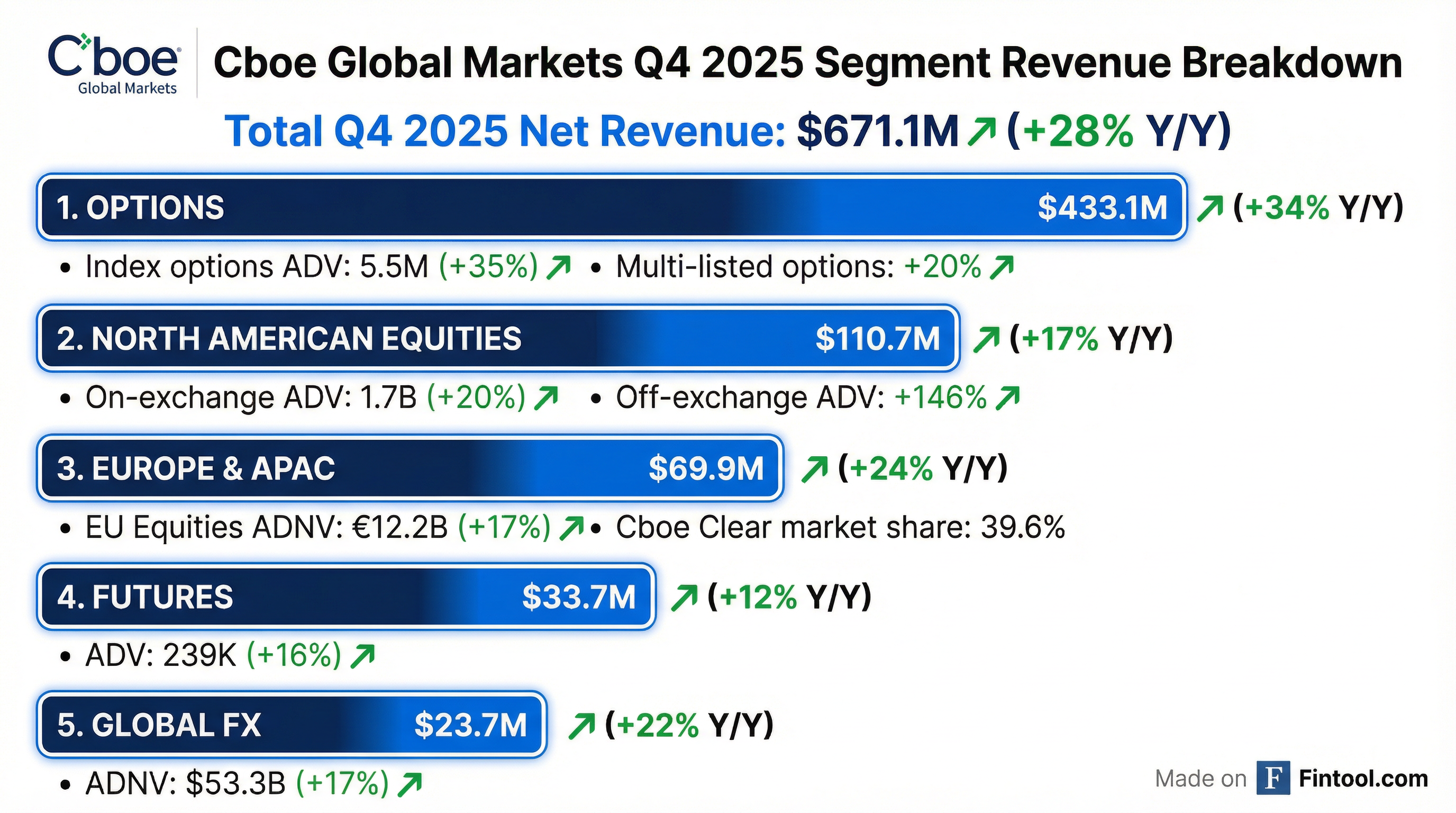

Segment Performance

Data Vantage — Cboe's recurring revenue data business — grew 9% Y/Y organically to $159.5 million, driven by new unit sales and product launches that "exceeded expectations" .

How Did the Stock React?

Despite the beat, CBOE shares fell 2.6% in after-hours trading to $268, reversing a 1.5% gain during the regular session.

The likely culprit: 2026 guidance came in softer than the blowout 2025 results would suggest.

What Did Management Guide for 2026?

The "mid single-digit" organic growth guidance represents a meaningful deceleration from 2025's 17% growth . While management didn't explicitly lower expectations for 0DTE, the implied volume normalization likely disappointed bulls expecting continued hypergrowth.

What Changed From Last Quarter?

Positives

- 0DTE acceleration: 0DTE SPX volume grew 66% Y/Y in Q4 — now 61% of total SPX volume (up from 51% a year ago)

- Global Trading Hours surge: GTH session volume up 34% Y/Y as international investors pile into U.S. markets

- Margin expansion: Adjusted EBITDA margin hit 69.2%, up 610 bps Y/Y as operating leverage kicked in

- Securities Financing traction: SFT clearing service saw notional outstanding loan values exceed €1 billion in January 2026

Concerns

- Conservative 2026 guidance: "Mid single-digit" organic growth implies significant deceleration

- Market share erosion: Multi-listed options share fell 160 bps to 22.9%

- Expense growth: Compensation and benefits up 12% Y/Y, suggesting wage pressure

Key Management Quotes

CEO Craig Donohue on strategic priorities (from earnings presentation):

"Leadership Reinforcing Core Growth and the Strategic Direction... Focus on driving and fully capturing growth potential in our core capabilities of Index Options, Multi-List Options, Futures, U.S. Equities, EU Equities, and FX"

On capital allocation, Cboe returned $76 million in dividends during Q4 (no share repurchases), with $2.2 billion in adjusted cash and 0.9x leverage ratio . The company raised its dividend 14% in August 2025 and returned a total of $350 million to shareholders in 2025 .

Q&A Highlights

Prediction Markets: Q2 2026 Launch Target

Global Head of Derivatives Rob Hocking provided the most detailed update yet on Cboe's prediction market strategy:

"Our first initial offerings will be securities products. We think that's the best way to reach the broadest set of end users, and it clearly differentiates what we're doing from a lot of the non-security-based platforms already in the market."

Key points on event contracts:

- Launch timing: Targeting Q2 2026, pending regulatory approval and partner readiness

- Product design: Binary/all-or-none contracts aligned with SPX options ecosystem — leveraging 200,000+ daily SPX 0DTE spreads that already have "effectively binary payouts"

- Securities-based: Index-based to start, potentially expanding to other securities

- Regulatory tailwinds: Encouraged by Chair Atkins' and Chair Selig's comments on clearer lines between securities vs. CFD-regulated swaps

Single-Name 0DTE: Additive, Not Cannibalistic

Management pushed back strongly on concerns that Monday/Wednesday single-stock 0DTE options would cannibalize SPX:

"SPX tends to be more smooth because it's a diversified basket. Price moves tend to be more macro-driven. They're well-telegraphed. Single names are different. They're driven by more company-specific news, which really means more gaps. Call it sharper jumps, fatter tails."

Critical product differences highlighted:

- Settlement: SPX is cash-settled/European-style; single names are physically settled/American-style (creating overnight stock position risk)

- Early uptake: Monday/Wednesday options concentrated in NVIDIA and Tesla, ranging 10%-30% of total volume in the 9 launched names

- Investor education: Cboe emphasized it's "hyper-focused" on ensuring investors understand the differences before trading

International Expansion Accelerating

45% of new data sales came from overseas clients in Q4, up from 35% a year ago . Three of the top five recurring sales were from Asia-Pacific clients.

Broker onboarding progress:

- Korea: 7 of 10 identified local brokers now offer SPX options (vs. 0 two years ago)

- Taiwan: First local retail broker launched SPX and VIX options in Q4, with more expected in 2026

- Robinhood: Continues to see strong options growth; management cited their 40%-45% options penetration growth target

Extended Trading Hours Roadmap

Multi-listed extended hours will start with 25 high-cap, high-liquidity names to avoid burdening liquidity providers .

ORF Reform Discussions

Cboe is engaging with industry participants on Options Regulatory Fee (ORF) reform — a per-contract fee charged on customer trades regardless of execution venue. With 20 options exchanges now operating, the cumulative ORF burden has become a friction point:

"Cboe firmly believes and is supportive of aligning fees with where the actual trades are done."

Leadership Changes

Cboe announced executive appointments to support its growth strategy :

- Scott Johnston → EVP, Chief Operating Officer (new)

- Heidi Fischer → EVP, Global Head of Equities and Spot Markets (new)

- Rob Hocking → EVP, Global Head of Derivatives

Chris Isaacson is departing after 20+ years (founding BATS employee since 2005) to spend more time with family. He will serve as an advisor through 2026 . CEO Donohue noted new hires average 25+ years of industry experience .

Strategic Realignment Update

CFO Jill Griebenow provided clarity on the portfolio rationalization announced in October 2025 :

On CEDEX, management cited "the retail investing landscape and market structure in Europe" as reasons the business was unlikely to meet profitability targets .

What Are the Forward Catalysts?

The Bottom Line

Cboe delivered a blowout Q4 driven by its proprietary SPX options franchise, where 0DTE trading continues to defy skeptics with 66% growth. The record-setting quarter pushed full-year adjusted EPS to $10.67, up 24% Y/Y. However, 2026 guidance implying "mid single-digit" organic growth disappointed investors expecting continued hypergrowth, sending shares down 2.6% after-hours. The key debate: Is this a normalization after an exceptional year, or the beginning of 0DTE saturation? With the stock up 32% over the past year, the bar was simply too high.

Related: CBOE Company Profile | Q4 2025 Earnings Transcript | Q3 2025 Earnings